How to secure export transactions? Good ways

Securing export transactions is a key element in international business, allowing companies to minimize risks associated with the unpredictability of foreign markets, exchange rate fluctuations, regulatory barriers, and the risk of non-payment from partners. Export transactions may encounter various issues that could lead to financial losses, delays, or even complete contract loss. In this outline, we will discuss the main methods for securing export transactions, including financial and operational tools, contracts, and legal and organizational measures, while providing examples of how these methods are applied in practice.

The first and most important element in securing an export transaction is conducting proper market research and assessing potential business partners. Risk analysis related to the political, economic, and legal situation in the target country helps identify potential threats and allows for better transaction protection. For example, if exporting to a country with high political instability, a company may consider protective measures such as insuring transactions against political risks. In this context, specialized insurance policies protect exporters against risks arising from sudden changes in trade policies, nationalization, fund freezes, or embargoes on goods and services.

One of the primary ways to secure export transactions is to use different forms of payment security. The most popular and commonly used form is the documentary letter of credit, which is a commitment by the buyer’s bank to pay the exporter a specified amount upon meeting the conditions set in the trade agreement and presenting the required documents, such as an invoice, bill of lading, quality certificate, or other documents requested by the buyer. A letter of credit allows the exporter to receive payment for their goods even if the buyer faces financial difficulties or does not intend to pay, as long as the letter of credit’s conditions are met. For instance, a company exporting electronic devices to a distant country might introduce a letter of credit as part of the agreement, thereby minimizing the risk that the client will fail to make payment.

Another tool is the export bill of exchange, which serves as payment security if the buyer fails to pay. The bill of exchange can be transferred to third parties, allowing the exporter to quickly sell the document and obtain cash. Issuing a bill of exchange is most effective when the exporter's partner is trustworthy or when the bill is guaranteed by a bank. Using bills of exchange is especially common in trade relations with partners from countries where the legal system allows for the easy and fast enforcement of such documents. An example could be the export of agricultural products to Eastern European countries, where bills of exchange are a popular tool for securing payments.

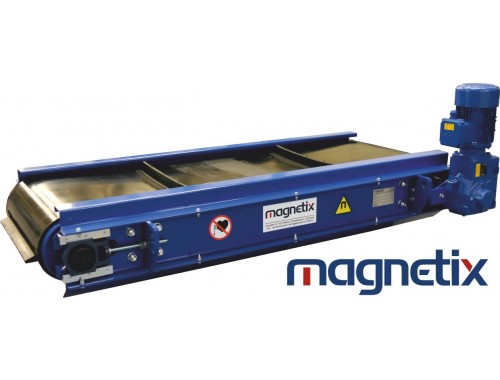

Transfer of title as collateral, a type of agreement where the exporter retains ownership of goods until full payment, is another protection mechanism for export transactions. This can be applied in export agreements when the exporter delivers goods to the buyer's country under prepayment terms or installment sales. By using the transfer of title as collateral, the exporter can recover their goods in case the buyer becomes insolvent. For example, a company exporting industrial machinery can reserve ownership of the machinery until full payment, allowing it to reclaim the machinery if the buyer does not meet the agreement.

In terms of currency risk, exporters can use financial instruments such as forward contracts, currency options, or swaps. Exchange rate fluctuations can significantly impact the value of a transaction, especially when exporting to markets with high currency volatility. Forward contracts allow locking in an exchange rate at a specific level, eliminating the risk of an unfavorable rate in the future. For example, an exporter selling products to the U.S. market can secure the dollar exchange rate, avoiding losses due to potential currency depreciation. Currency options give the exporter the right (but not the obligation) to exchange currency at a specific rate, providing a more flexible tool but requiring higher costs related to the option premium.

Insurance for export transactions is another important means of protection against the risk of buyer insolvency. Trade credit insurance allows the exporter to receive compensation in the event of non-payment by the client. Insurance companies, such as KUKE (Export Credit Insurance Corporation) in Poland, offer specialized insurance products that protect exporters against the risk of buyer insolvency or payment delays. For example, a textile manufacturing company exporting products to the African market can choose trade credit insurance, gaining assurance that in the event of the buyer's insolvency, they can recover part or all of the receivables, allowing them to conduct business more securely.

Using bank guarantees is another method of securing export transactions. Bank guarantees are bank commitments that, in case of a buyer's default, the bank will pay the exporter a specified amount. These guarantees are especially useful in large orders and contracts with long execution times, where the risk of the buyer's insolvency is high. For example, exporting IT systems to another country’s government where the exporter requires a bank guarantee to protect against the risk of delays or non-payment for delivered services and products.

An essential part of transaction security is also drafting a proper export contract that specifies detailed conditions for delivery, payment, liability for quality, and transport risk. A well-drafted contract should include clauses regarding payment terms, delay penalties, complaint procedures, and dispute resolution mechanisms. A properly secured contract helps avoid legal disputes and streamlines claims in unforeseen circumstances. For instance, a company exporting furniture can include contractual clauses on liquidated damages for delivery delays or product quality defects, enabling them to obtain compensation if the buyer breaches the contract.

Another aspect of securing export transactions is proper cargo insurance. Exporters can choose from various forms of cargo insurance, which protects against the risk of damage or loss of goods during transit. A transportation insurance policy protects exporters from risks arising from accidents, theft, damage, or other unforeseen events. An example could be a company exporting medical equipment, which purchases insurance for the goods transported by sea to Asian countries to mitigate the risk of damage during transport.

In summary, securing export transactions is a multifaceted process that includes choosing appropriate financial, legal, insurance, and logistical tools. Effective export risk management requires collaboration with experienced partners, such as banks, insurance companies, and legal experts, who can assist in risk analysis and selecting the most effective methods to protect transactions. Examples of using the discussed solutions demonstrate that securing export transactions not only protects businesses from losses but also enables stable growth and expansion into foreign markets.

- Economy

- Export

- International cooperation

- Construction sector - Joinery, engineering and building architecture

- Agriculture, Food

- Regional development, investment in Poland

- What's worth knowing

What's worth knowing

How to secure export transactions? Good ways

Source: https://www.poland-export.com/

See also:

Chocolate and chocolate products from Poland

For years, Poland has been strengthening its position as one of the key exporters of chocolate products in Europe. Chocolate exports constitute an important segment of Polish foreign trade and cover a wide range of chocolate products

Cherry Export. Polish Cherries Around the World

The export of cherries from Poland is playing an increasingly important role in the international fruit market.

Cosmetics export. Cosmetics from Poland

The export of cosmetics and toiletries from Poland is developing at a dynamic pace, thanks to which Poland has gained the status of one of the leaders in the production and sale of these products in Central and Eastern Europe

Export of Windows: Window Joinery from Poland

Poland has been playing an important role on the international window market for many years, being one of the largest window exporters in the world.

FTA - Free Trade Agreements: Do They Exist and Can They Lower Tariffs?

Free Trade Agreements (FTAs) are key tools in international trade policy, aimed at reducing trade barriers...

Help needed ?

If you have not found the desired product, company, service or the searching results are not satisfactory for you, do not hesitate to contact us and tell what you are looking for or what you need. We will send your inquiry directly to the interested companies.

Write to us

pl

pl  en

en  de

de  es

es  fr

fr  it

it  pt

pt  ru

ru  sv

sv

.jpg)